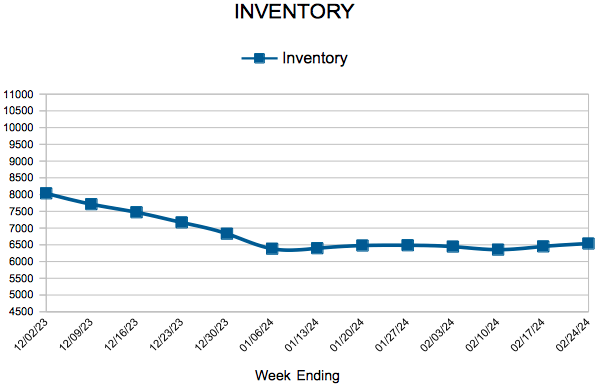

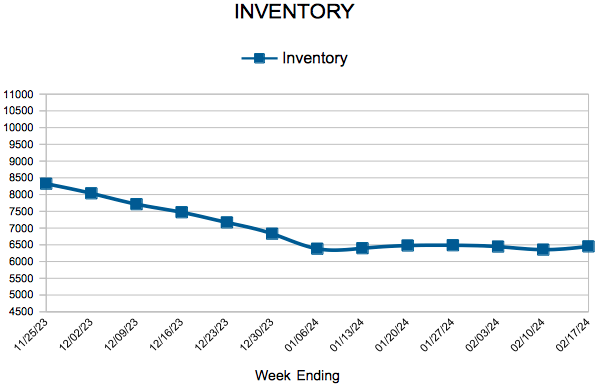

Inventory

Weekly Market Report

For Week Ending February 24, 2024

For Week Ending February 24, 2024

U.S. housing starts fell 14.8% month-over-month in January to a seasonally adjusted annual rate of 1,331,000 units, according to data from the U.S. Census Bureau. Single-family starts dropped 4.7% from the previous month, while multi-family starts declined 35.8%. Although construction was down for the month, builder sentiment continues to improve, rising to the highest level since August 2023, according to the National Association of Home Builders (NAHB) / Wells Fargo Housing Market Index (HMI).

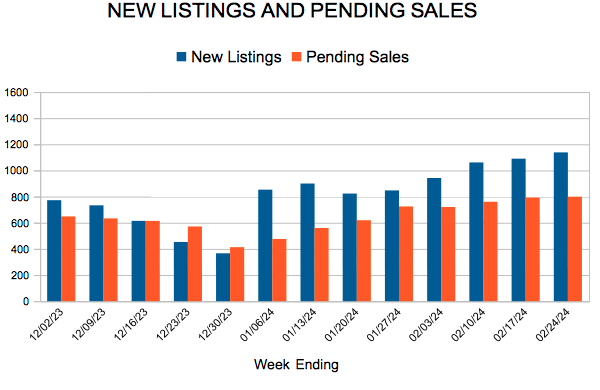

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 24:

- New Listings increased 48.6% to 1,138

- Pending Sales increased 7.0% to 799

- Inventory increased 5.7% to 6,537

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 3.1% to $352,500

- Days on Market decreased 8.2% to 56

- Percent of Original List Price Received increased 0.7% to 96.7%

- Months Supply of Homes For Sale increased 28.6% to 1.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

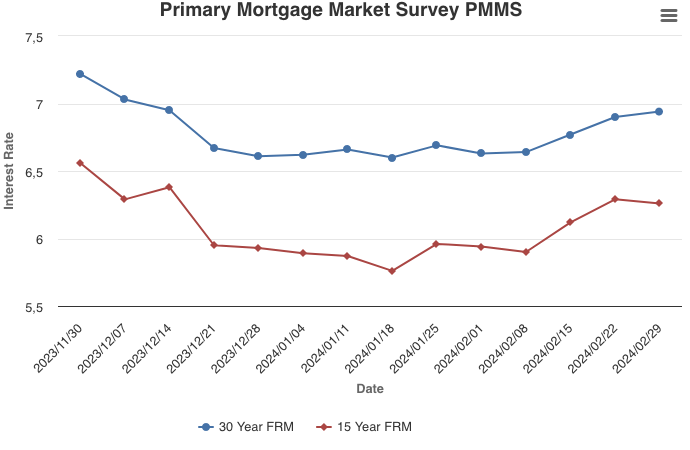

Mortgage Rates Increase for the Fourth Consecutive Week

February 29, 2024

Mortgage rates continued their ascent this week, reaching a two-month high and flirting with seven percent yet again. The recent boomerang in rates has dampened already tentative homebuyer momentum approaching the spring, a historically busy season for homebuying. While sales of newly built homes are trending in a positive direction, higher rates and elevated prices continue to pose affordability challenges that may leave potential homebuyers on the sidelines.

Information provided by Freddie Mac.

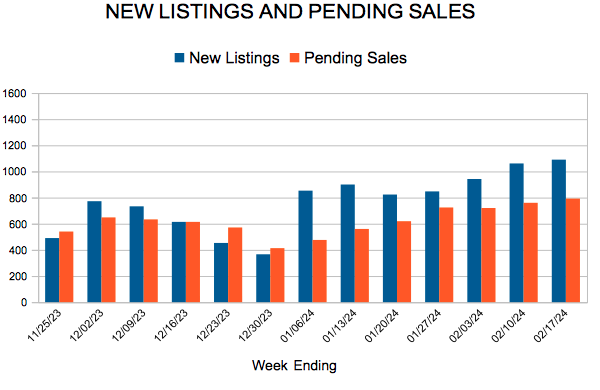

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending February 17, 2024

For Week Ending February 17, 2024

Housing inventory improved for the third month in a row, with the number of homes actively for sale in January increasing 7.9% year-over-year, according to Realtor.com’s January 2024 Monthly Housing Market Trends Report. Lower mortgage rates appear to have brought some sellers back to the market, as the number of newly listed homes rose 2.8% year-over-year. While this is good news for prospective homebuyers, the supply of homes for sale remains down compared to typical 2017 – 2019 levels.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 17:

- New Listings increased 14.7% to 1,090

- Pending Sales increased 11.2% to 792

- Inventory increased 4.9% to 6,451

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 3.1% to $352,500

- Days on Market decreased 8.2% to 56

- Percent of Original List Price Received increased 0.7% to 96.7%

- Months Supply of Homes For Sale increased 28.6% to 1.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

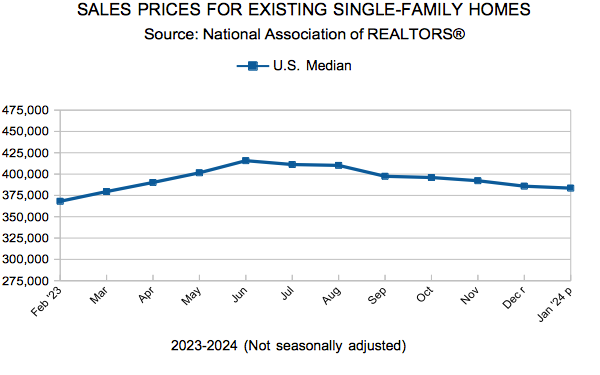

Existing Home Sales

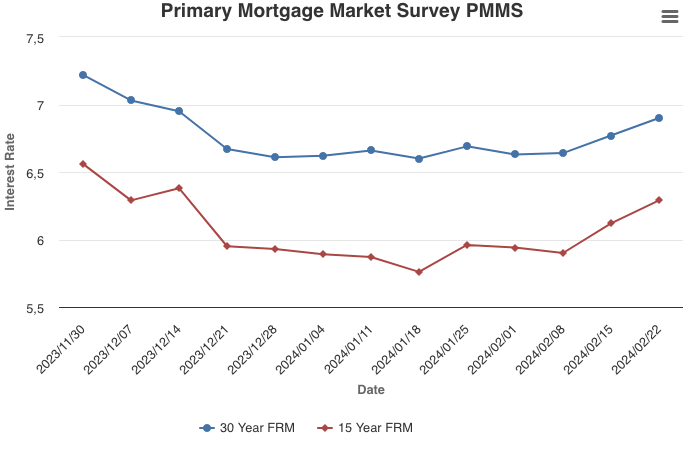

Mortgage Rates Continue to Rise, Nearing Seven Percent

February 22, 2024

Strong incoming economic and inflation data has caused the market to re-evaluate the path of monetary policy, leading to higher mortgage rates. Historically, the combination of a vibrant economy and modestly higher rates did not meaningfully impact the housing market. The current cycle is different than historical norms, as housing affordability is so low that good economic news equates to bad news for homebuyers, who are sensitive to even minor shifts in affordability.

Information provided by Freddie Mac.

January Monthly Skinny Video

- « Previous Page

- 1

- …

- 35

- 36

- 37

- 38

- 39

- …

- 89

- Next Page »