February 15, 2024

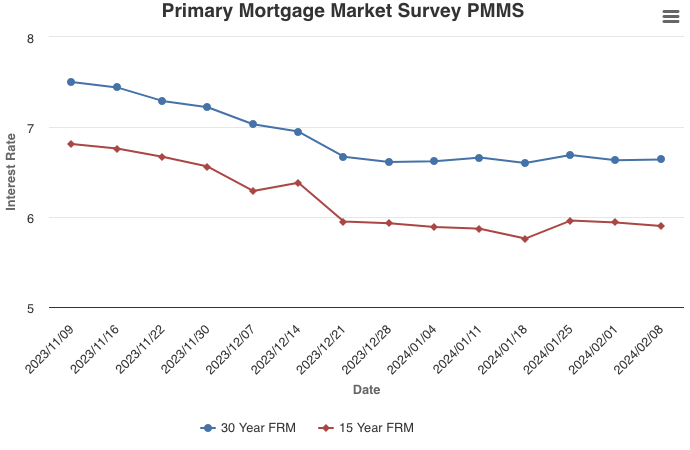

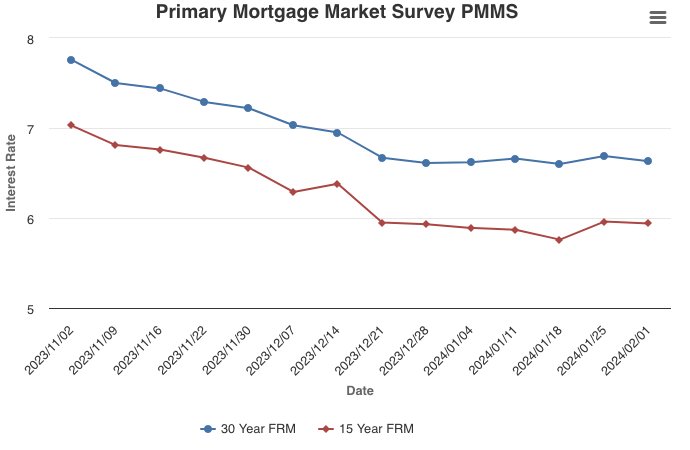

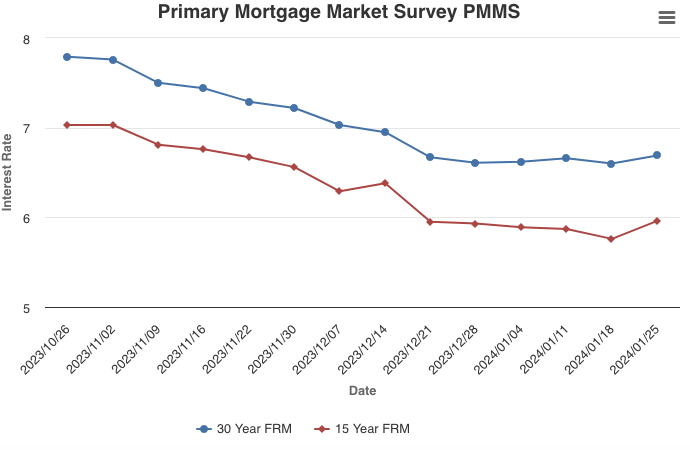

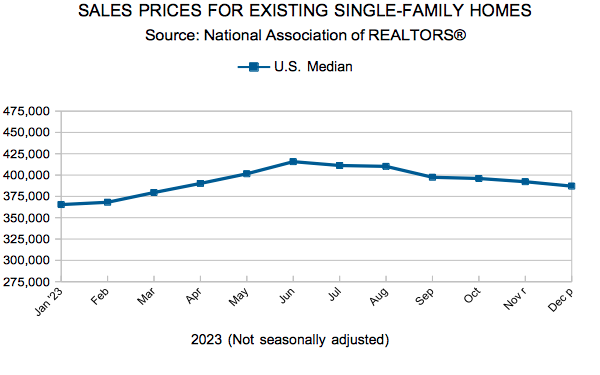

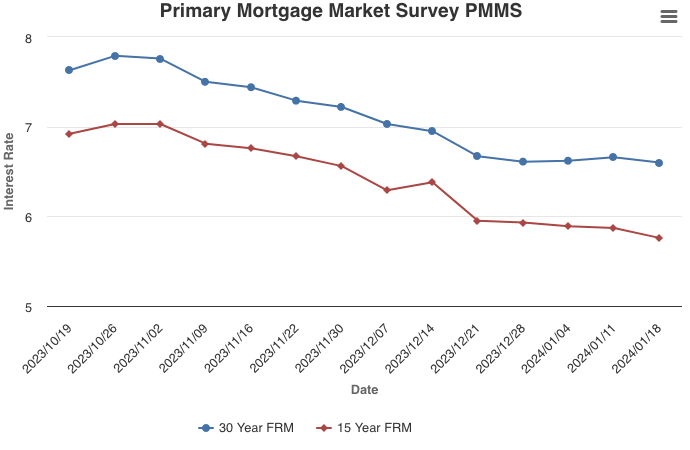

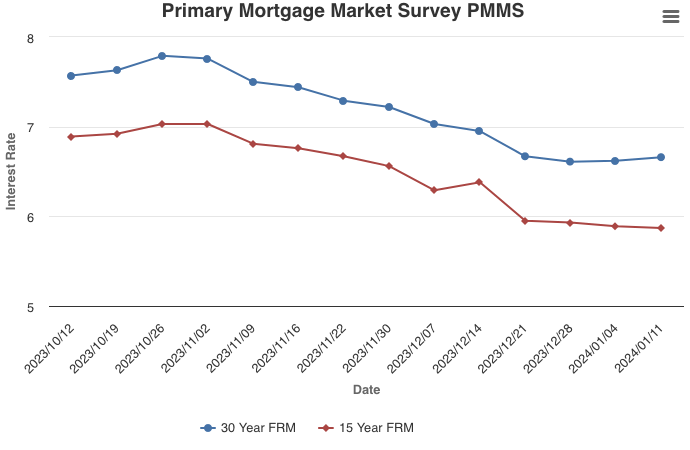

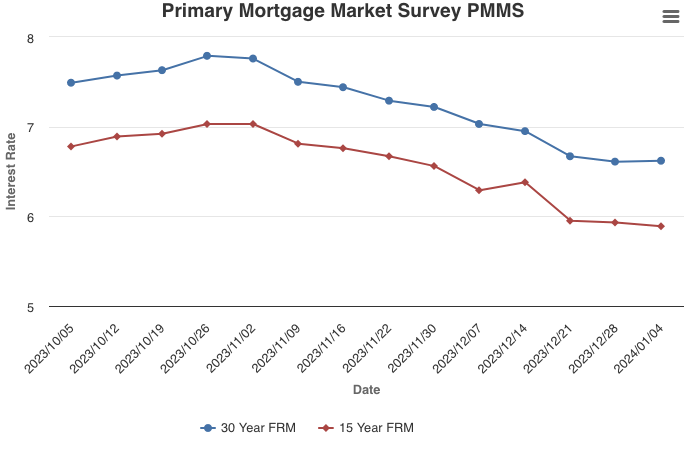

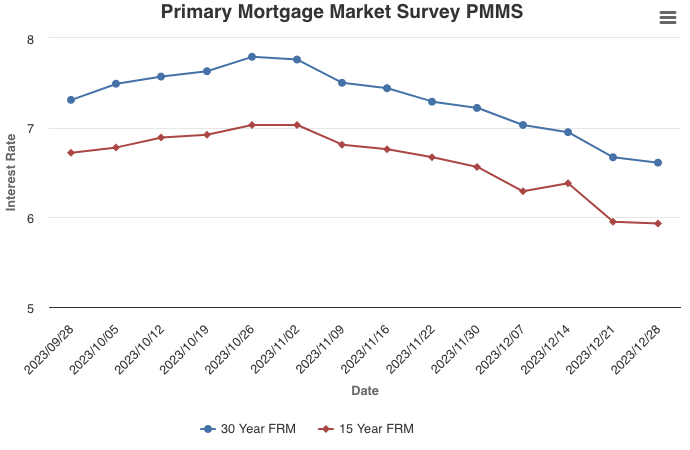

On the heels of consumer prices rising more than expected, mortgage rates increased this week. The economy has been performing well so far this year and rates may stay higher for longer, potentially slowing the spring homebuying season. According to Freddie Mac data, mortgage applications to buy a home so far in 2024 are down in more than half of all states compared to a year earlier.

Information provided by Freddie Mac.