September 21, 2023

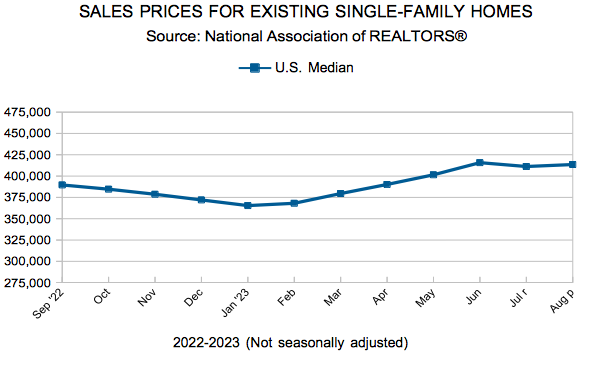

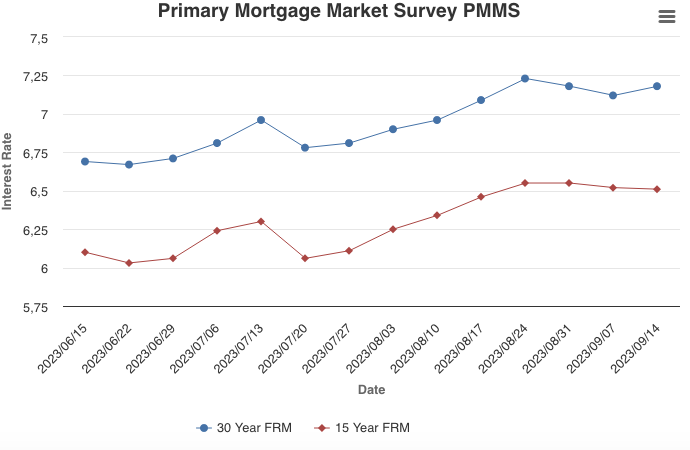

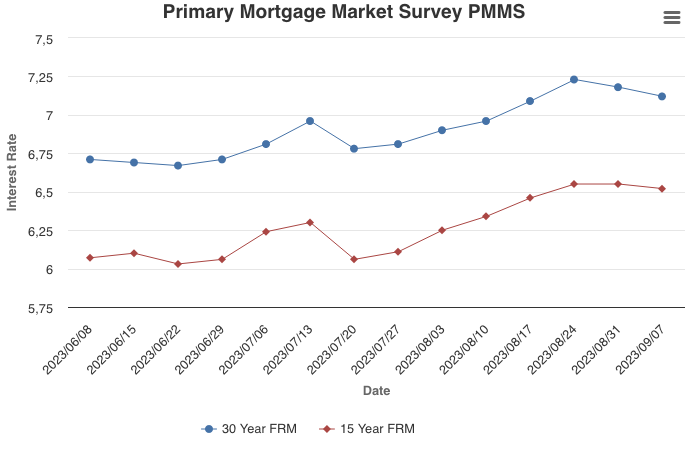

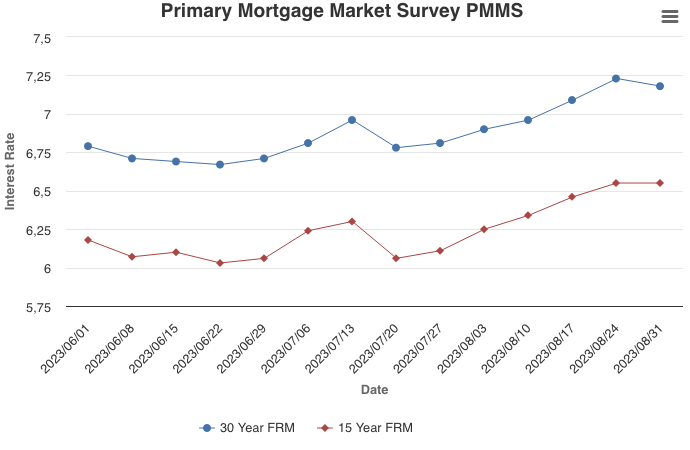

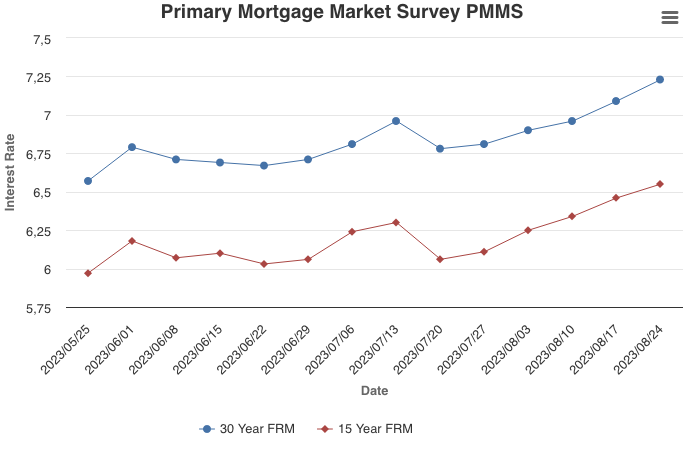

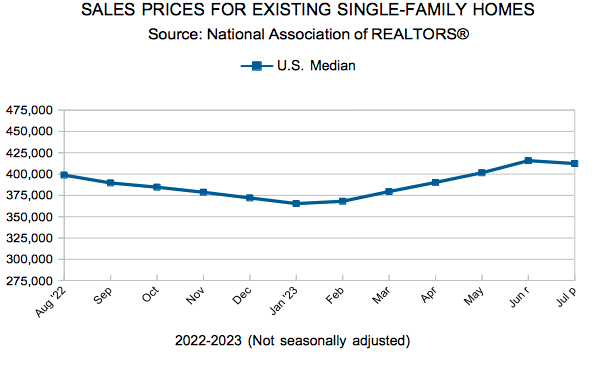

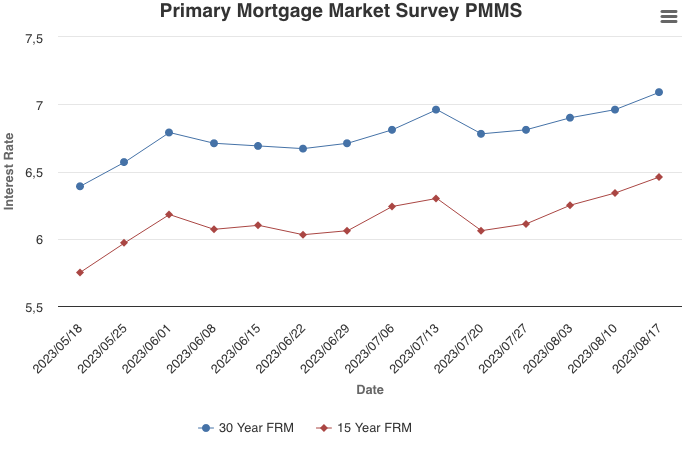

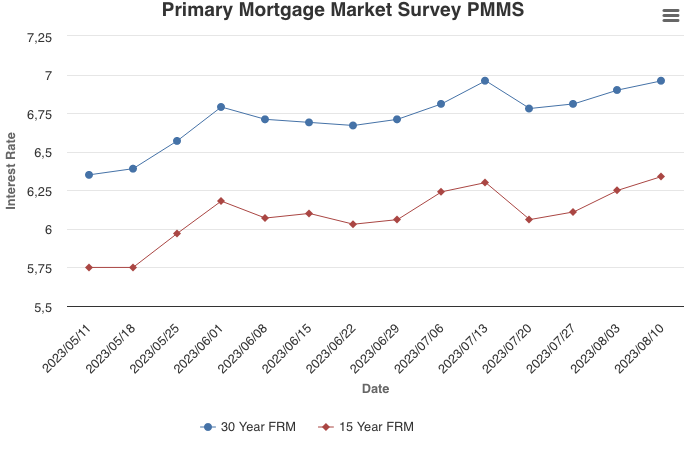

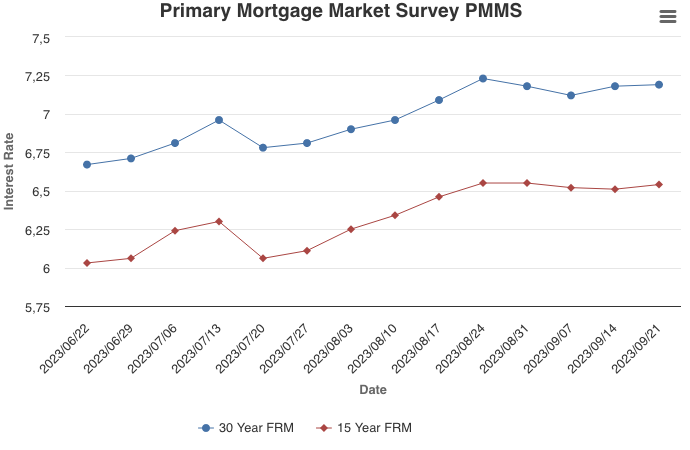

Mortgage rates continue to linger above seven percent as the Federal Reserve paused their interest rate hikes. Given these high rates, housing demand is cooling off and now homebuilders are feeling the effect. Builder sentiment declined for the first time in several months and construction levels have dipped to a three-year low, which could have an impact on the already low housing supply.

Information provided by Freddie Mac.