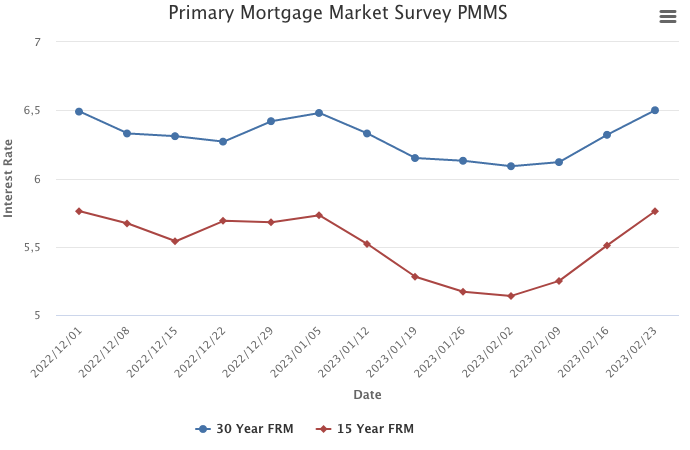

March 9, 2023

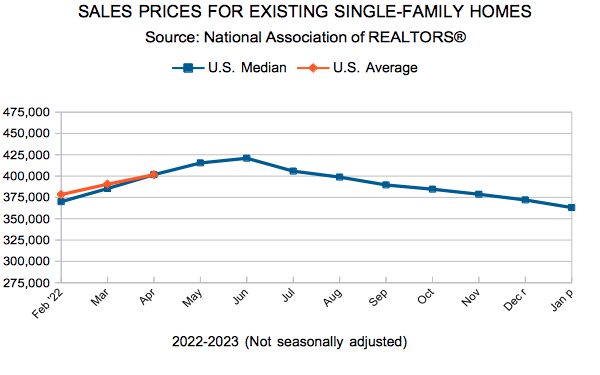

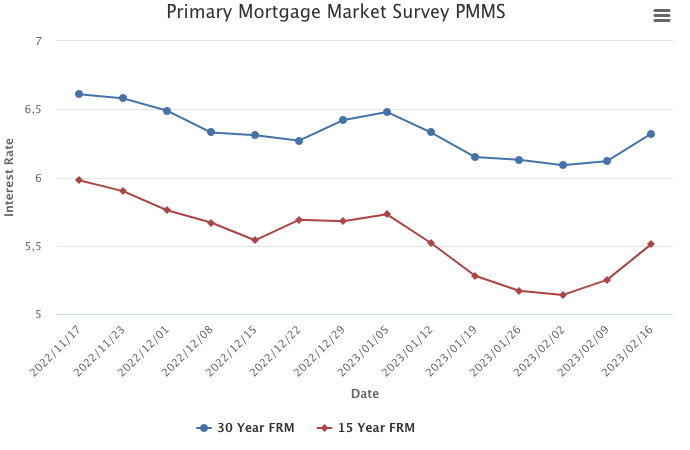

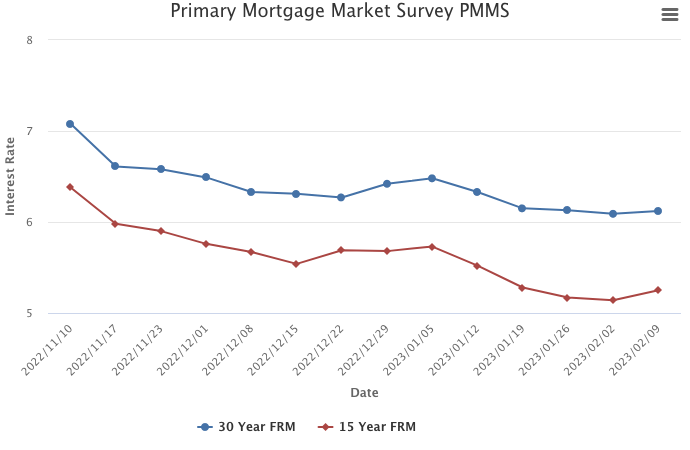

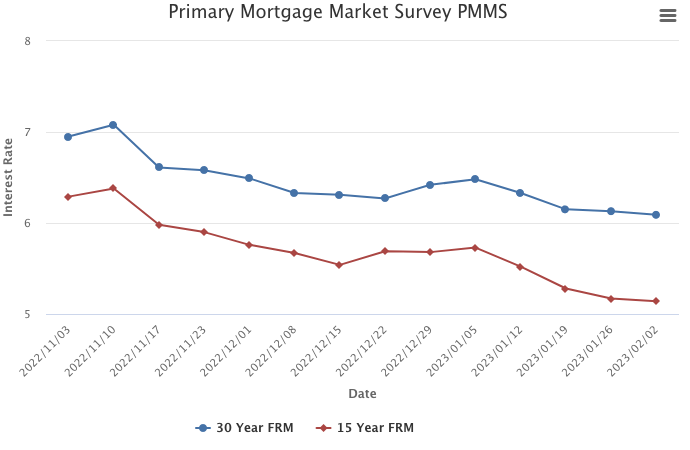

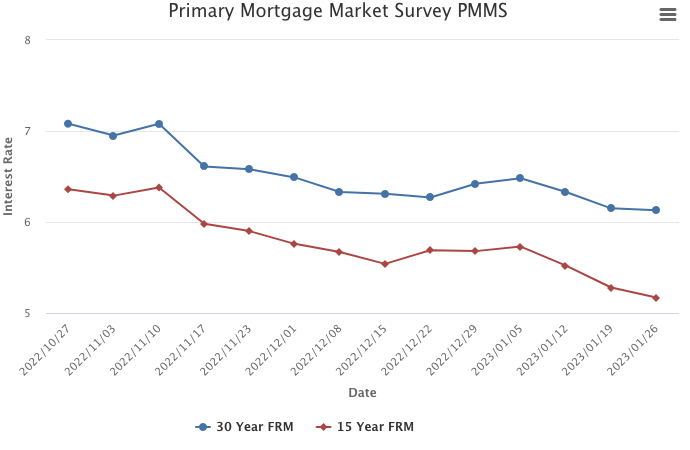

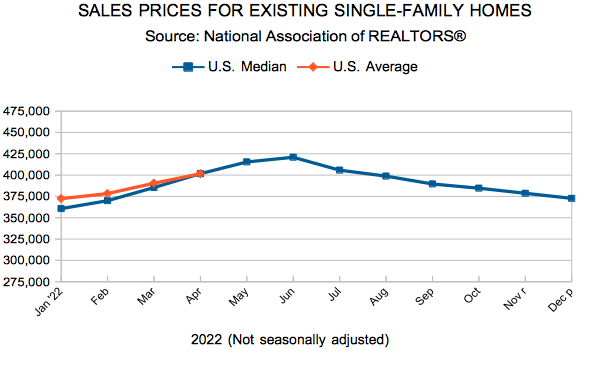

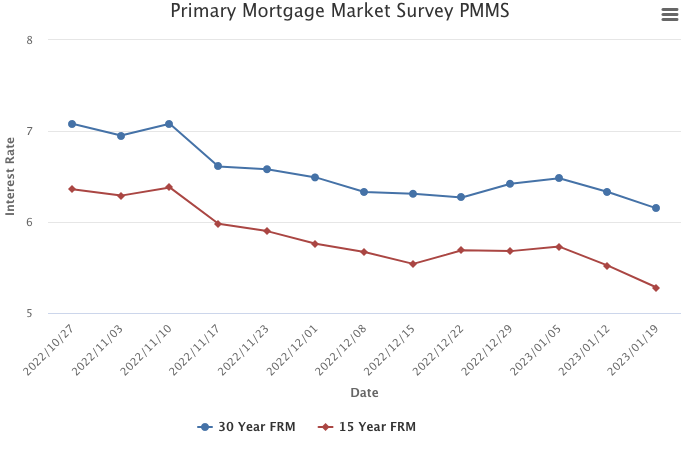

Mortgage rates continue their upward trajectory as the Federal Reserve signals a more aggressive stance on monetary policy. Overall, consumers are spending in sectors that are not interest rate sensitive, such as travel and dining out. However, rate-sensitive sectors, such as housing, continue to be adversely affected. As a result, would-be homebuyers continue to face the compounding challenges of affordability and low inventory.

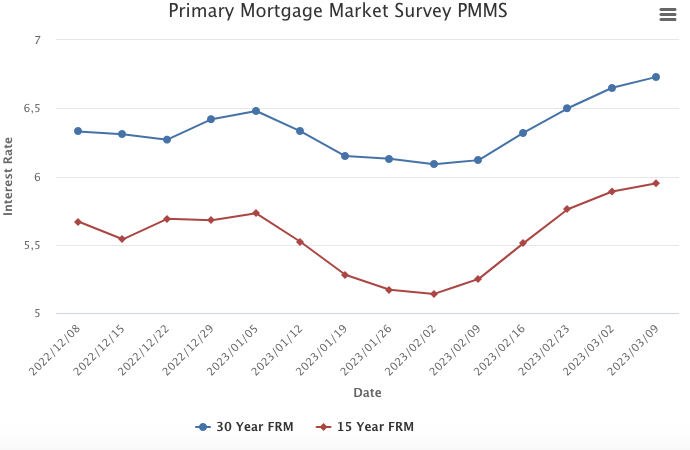

Information provided by Freddie Mac.