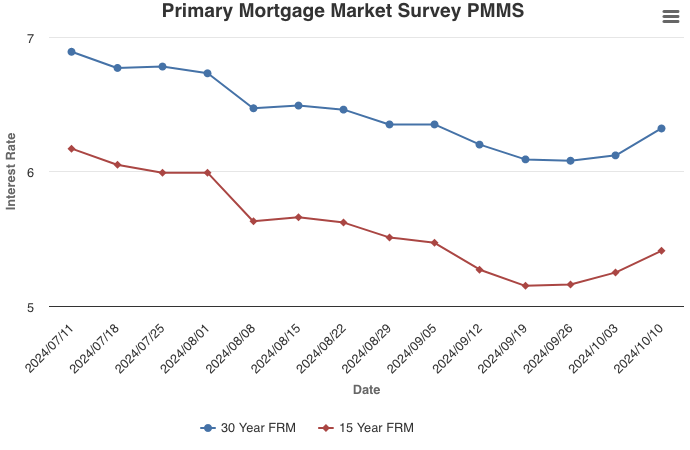

October 10, 2024

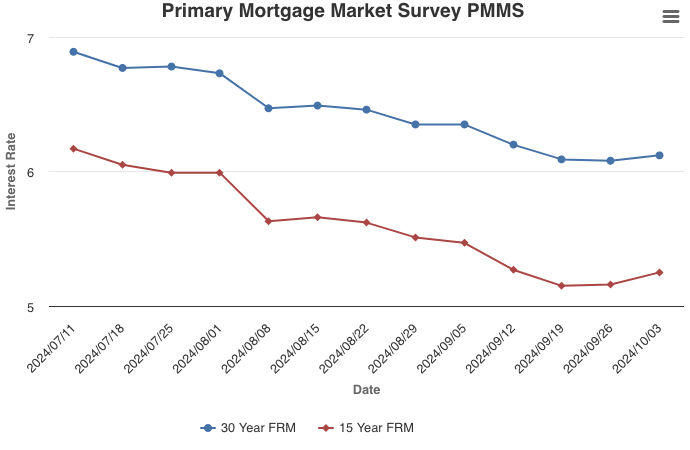

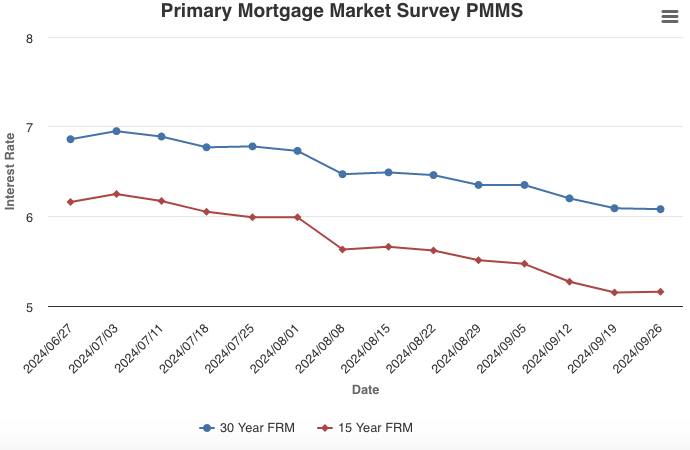

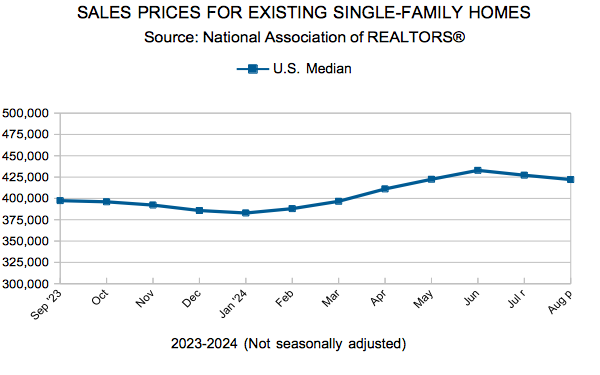

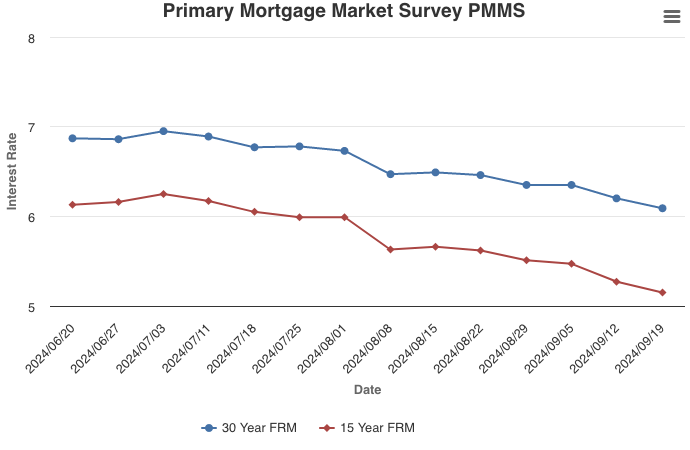

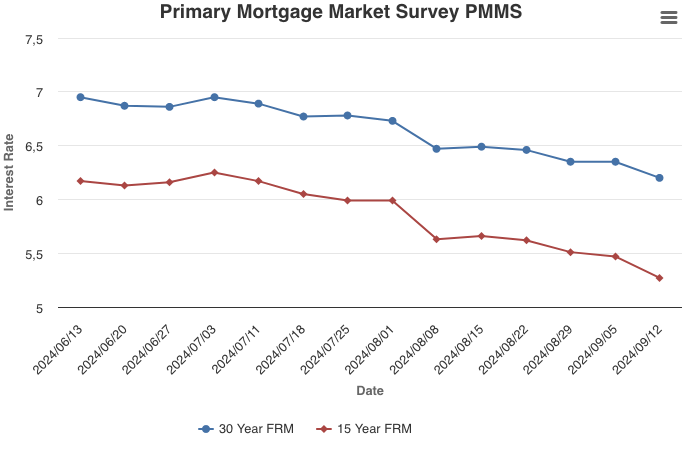

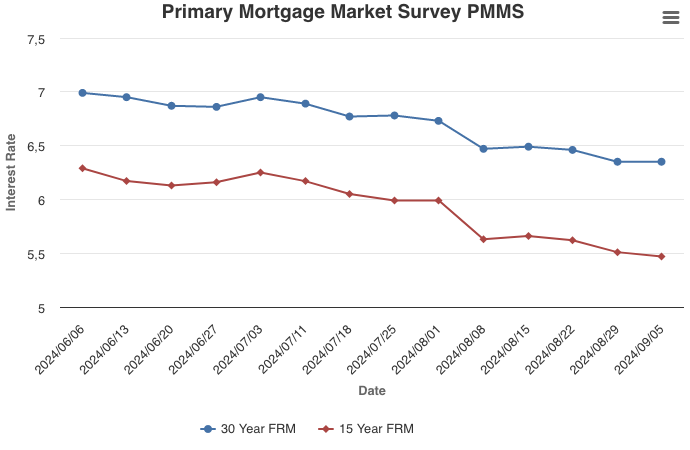

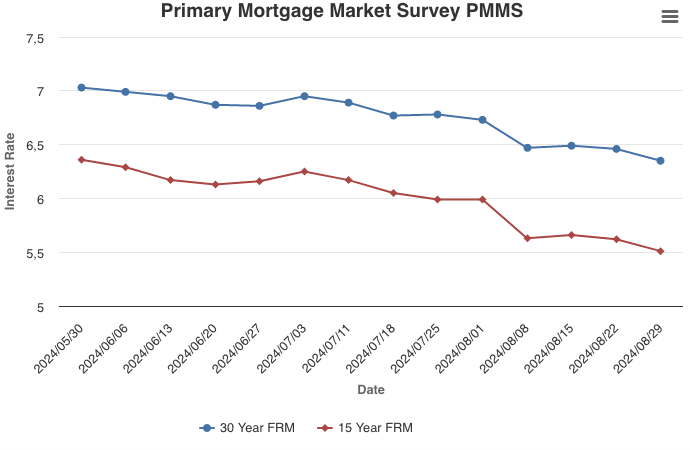

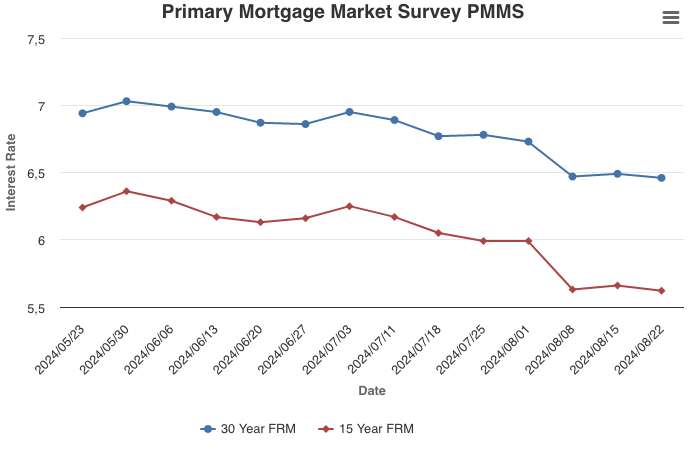

Following the release of a stronger-than-expected September jobs report, the 30-year fixed rate mortgage saw the largest one-week increase since April. However, the rise in rates is largely due to shifts in expectations and not the underlying economy, which has been strong for most of the year. Although higher rates make affordability more challenging, it shows the economic strength that should continue to support the recovery of the housing market.

Information provided by Freddie Mac.