Weekly Market Report

For Week Ending August 31, 2024

For Week Ending August 31, 2024

49.2% of mortgaged residential properties in the U.S. were considered equity rich—having at least 50% equity in one’s home–in the second quarter of 2024, according to ATTOM’s Q2 2024 U.S. Home Equity and Underwater Report. This is an increase from the previous quarter, when 45.8% of mortgaged homes were considered equity-rich, with the largest quarterly increases found in lower-priced markets in the South and Midwest regions.

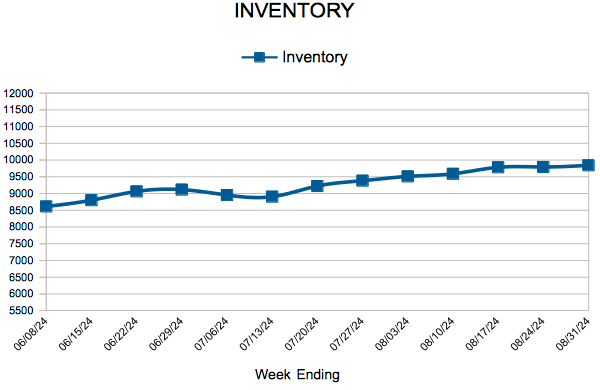

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 31:

- New Listings decreased 10.7% to 1,096

- Pending Sales decreased 8.5% to 870

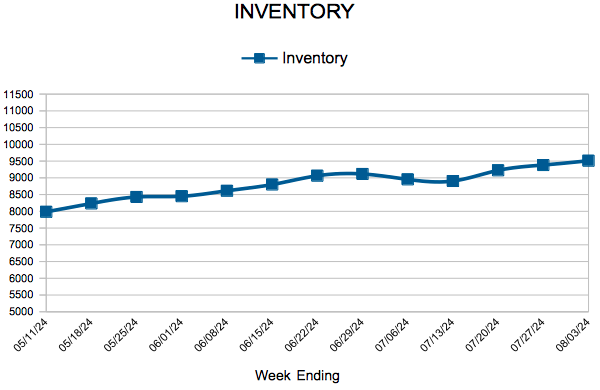

- Inventory increased 12.7% to 9,842

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.7% to $385,000

- Days on Market increased 24.7% to 36

- Percent of Original List Price Received decreased 1.3% to 99.5%

- Months Supply of Homes For Sale increased 18.2% to 2.6

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 24, 2024

For Week Ending August 24, 2024

U.S. housing starts fell 6.8% month-over-month and 16.0% year-over-year to a seasonally adjusted annual rate of 1,238,000 units, according to the U.S. Census Bureau. Building permits also declined as of last measure, sliding 4% month-over-month to a seasonally adjusted annual rate of 1,396,000 units. Analysts say Hurricane Beryl, along with elevated interest rates in July, likely impacted construction activity.

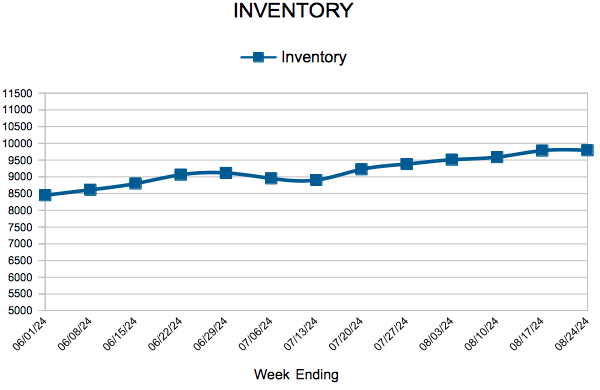

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 24:

- New Listings decreased 3.9% to 1,268

- Pending Sales decreased 9.2% to 845

- Inventory increased 13.6% to 9,793

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.7% to $385,000

- Days on Market increased 24.1% to 36

- Percent of Original List Price Received decreased 1.3% to 99.5%

- Months Supply of Homes For Sale increased 18.2% to 2.6

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 17, 2024

For Week Ending August 17, 2024

The number of homes for sale continues to improve nationwide, marking the ninth straight month of growth. According to Realtor.com’s July 2024 Monthly Housing Market Trends Report, there were 36.6% more homes on the market in July compared to the same period last year. Prospective buyers, especially first-time homebuyers, will be pleased to know the growth in homes priced between $200,000 – $350,000 jumped 47.3% year-over-year, outpacing all other price categories.

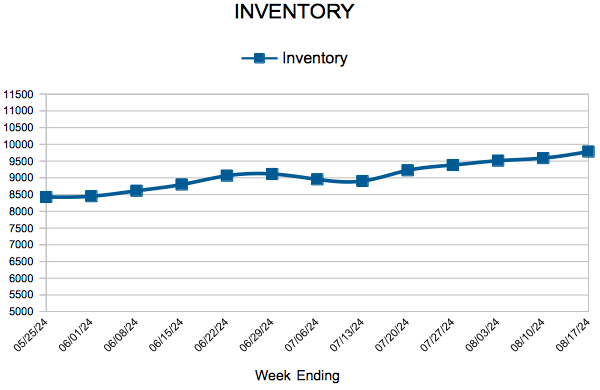

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 17:

- New Listings increased 3.1% to 1,320

- Pending Sales decreased 5.4% to 925

- Inventory increased 14.4% to 9,783

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.7% to $385,000

- Days on Market increased 24.7% to 36

- Percent of Original List Price Received decreased 1.3% to 99.5%

- Months Supply of Homes For Sale increased 18.2% to 2.6

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 10, 2024

For Week Ending August 10, 2024

Homebuyer preferences for smaller homes continue to influence builder behavior. According to the U.S. Census Bureau, the typical new single-family home under construction had a median floor area of 2,139 square feet in the first quarter of 2024. That’s down from the same period last year, when the typical new home had a median floor area of 2,256 square feet, and the lowest reading since 2009, according to the National Association of Home Builders.

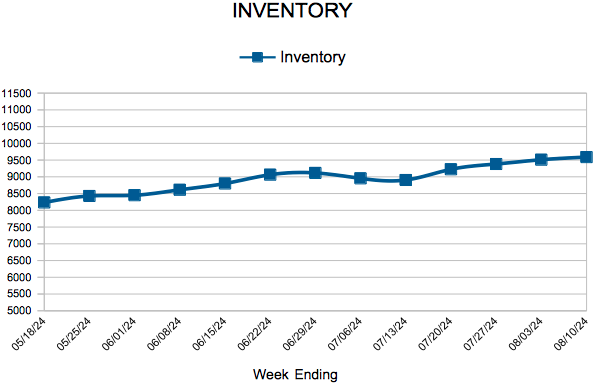

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 10:

- New Listings increased 4.3% to 1,485

- Pending Sales decreased 17.3% to 906

- Inventory increased 12.9% to 9,589

FOR THE MONTH OF JULY:

- Median Sales Price increased 2.7% to $385,000

- Days on Market increased 24.7% to 36

- Percent of Original List Price Received decreased 1.3% to 99.5%

- Months Supply of Homes For Sale increased 18.2% to 2.6

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 3, 2024

For Week Ending August 3, 2024

The average rate on a 30-year mortgage fell to 6.73% the week ending August 1, 2024, the lowest level since early February, according to Freddie Mac. As a result, mortgage applications increased 6.9% on a seasonally adjusted basis from the previous week, boosted by a surge in refinance applications, which jumped 16%, while purchase applications rose 1%, per the Mortgage Bankers Association’s Weekly Applications Survey.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 3:

- New Listings decreased 0.2% to 1,440

- Pending Sales decreased 0.4% to 1,052

- Inventory increased 12.8% to 9,511

FOR THE MONTH OF JUNE:

- Median Sales Price increased 1.8% to $390,000

- Days on Market increased 12.9% to 35

- Percent of Original List Price Received decreased 1.2% to 100.1%

- Months Supply of Homes For Sale increased 19.0% to 2.5

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 10

- 11

- 12

- 13

- 14

- …

- 40

- Next Page »