Weekly Market Report

For Week Ending March 2, 2024

For Week Ending March 2, 2024

The limited supply of existing-home inventory nationwide continues to benefit the new-home market, with applications for new home purchases up 38% month-over-month and 19.1% year-over-year in January, according to the Mortgage Bankers Association Builder Application Survey. The latest reading marks the 12th consecutive annual increase and is the strongest non-seasonally adjusted reading for the month in the survey’s history.

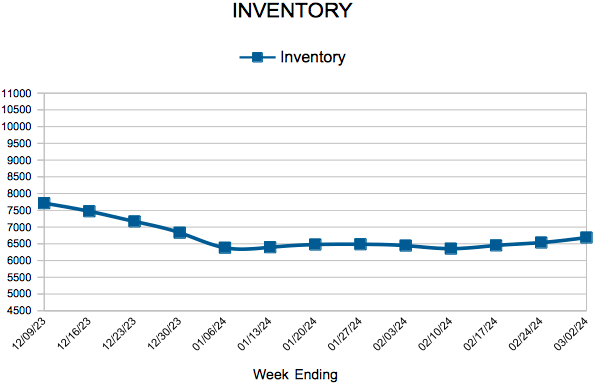

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 2:

- New Listings increased 2.5% to 1,198

- Pending Sales increased 10.0% to 845

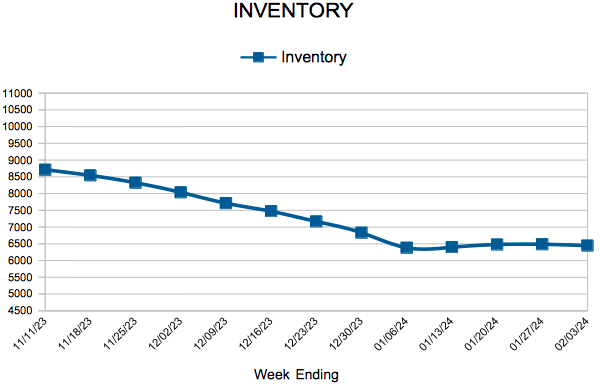

- Inventory increased 11.7% to 6,686

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 3.2% to $353,035

- Days on Market decreased 8.2% to 56

- Percent of Original List Price Received increased 0.6% to 96.6%

- Months Supply of Homes For Sale increased 28.6% to 1.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending February 24, 2024

For Week Ending February 24, 2024

U.S. housing starts fell 14.8% month-over-month in January to a seasonally adjusted annual rate of 1,331,000 units, according to data from the U.S. Census Bureau. Single-family starts dropped 4.7% from the previous month, while multi-family starts declined 35.8%. Although construction was down for the month, builder sentiment continues to improve, rising to the highest level since August 2023, according to the National Association of Home Builders (NAHB) / Wells Fargo Housing Market Index (HMI).

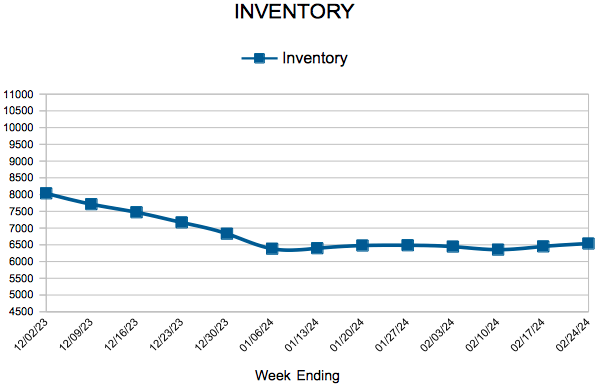

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 24:

- New Listings increased 48.6% to 1,138

- Pending Sales increased 7.0% to 799

- Inventory increased 5.7% to 6,537

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 3.1% to $352,500

- Days on Market decreased 8.2% to 56

- Percent of Original List Price Received increased 0.7% to 96.7%

- Months Supply of Homes For Sale increased 28.6% to 1.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending February 17, 2024

For Week Ending February 17, 2024

Housing inventory improved for the third month in a row, with the number of homes actively for sale in January increasing 7.9% year-over-year, according to Realtor.com’s January 2024 Monthly Housing Market Trends Report. Lower mortgage rates appear to have brought some sellers back to the market, as the number of newly listed homes rose 2.8% year-over-year. While this is good news for prospective homebuyers, the supply of homes for sale remains down compared to typical 2017 – 2019 levels.

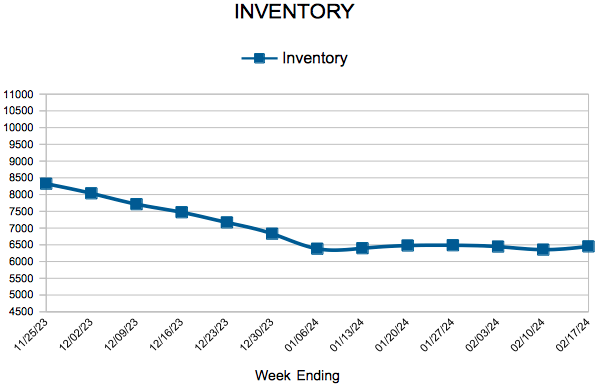

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 17:

- New Listings increased 14.7% to 1,090

- Pending Sales increased 11.2% to 792

- Inventory increased 4.9% to 6,451

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 3.1% to $352,500

- Days on Market decreased 8.2% to 56

- Percent of Original List Price Received increased 0.7% to 96.7%

- Months Supply of Homes For Sale increased 28.6% to 1.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending February 10, 2024

For Week Ending February 10, 2024

Seller profits declined for the first time since 2011, according to ATTOM’s Year-End 2023 U.S. Home Sales Report, which found that home sellers made a $121,000 profit on the sale of a median-priced single-family home in 2023, resulting in a 56.5% return on investment year-over-year. This is a slight drop from 2022, when home sellers made $122,600 on the sale of a typical single-family home, for a 59.8% return on investment. Despite the decline, however, seller profits and profit margins remained near record levels last year.

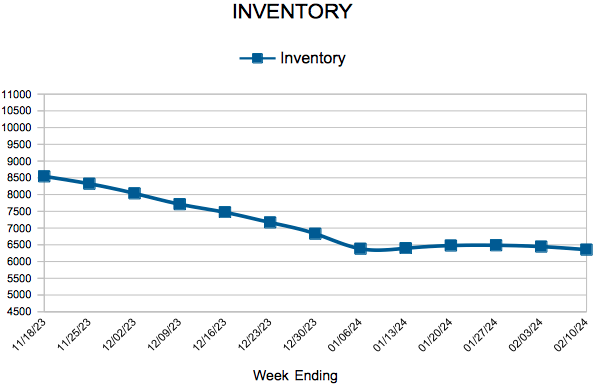

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 10:

- New Listings increased 18.4% to 1,061

- Pending Sales increased 6.1% to 760

- Inventory increased 3.5% to 6,355

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 3.2% to $353,035

- Days on Market decreased 8.2% to 56

- Percent of Original List Price Received increased 0.7% to 96.7%

- Months Supply of Homes For Sale increased 21.4% to 1.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending February 3, 2024

For Week Ending February 3, 2024

U.S. single-family rent growth was up 2.7% year-over-year as of last measure, according to Corelogic’s January 2024 U.S. Single-Family Rent Index, keeping in line with the annual rate of growth recorded prior to the pandemic. Attached singlefamily rents increased 3.3% year-over-year, while detached single-family rents rose 2.3%. Nationally, rent growth was highest in the lower-priced rental tiers, climbing 2.9% year-over-year.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 3:

- New Listings increased 17.9% to 942

- Pending Sales increased 4.2% to 720

- Inventory increased 2.6% to 6,446

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased increased 1.4% to $353,900

- Days on Market increased 2.0% to 51

- Percent of Original List Price Received increased 0.4% to 96.7%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 15

- 16

- 17

- 18

- 19

- …

- 40

- Next Page »