Weekly Market Report

For Week Ending October 14, 2023

For Week Ending October 14, 2023

According to ATTOM’s Q3 2023 U.S. Home Affordability Report, median priced single-family homes and condos were less affordable compared to historical averages in 99% of counties nationwide in the 3rd quarter of 2023. Home sale prices have continued to rise across the country, and with mortgage rates above 7%, major homeownership expenses now take up 35% of the average national wage, the highest level since 2007, and well above the 28% affordability standard commonly used by many lenders.

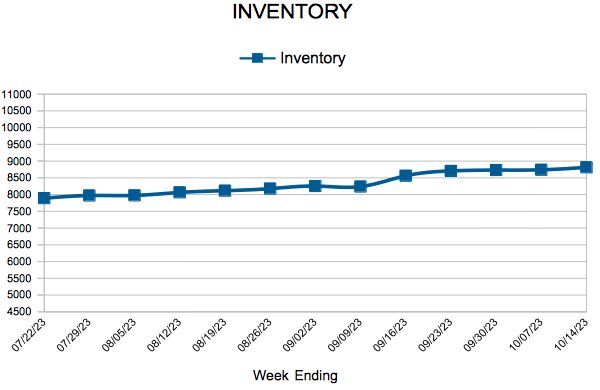

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 14:

- New Listings decreased 8.8% to 1,187

- Pending Sales decreased 6.3% to 800

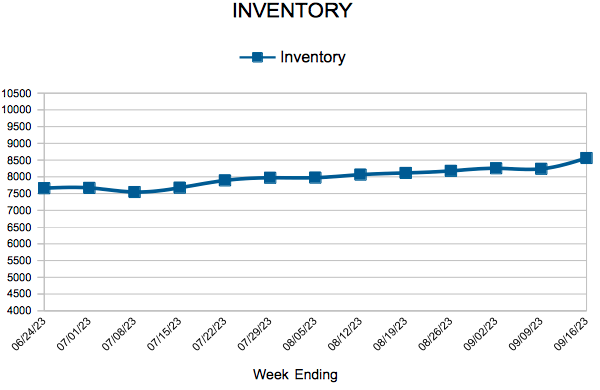

- Inventory decreased 7.8% to 8,813

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $371,000

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 7, 2023

For Week Ending October 7, 2023

Adjustable-rate mortgages (ARM) continue to grow in popularity as prospective homebuyers aim to combat rising housing costs. Applications for 5/1 adjustable-rate mortgages rose 32.5% the week ending October 6 from four weeks earlier, according to the Mortgage Bankers Association. Effective rates for a 5/1 ARM averaged about 6.66% compared to 7.49% for a traditional 30-year fixed-rate mortgage, with the share of ARM applicants representing 9.2% of all borrowers, the highest percentage since November 2022.

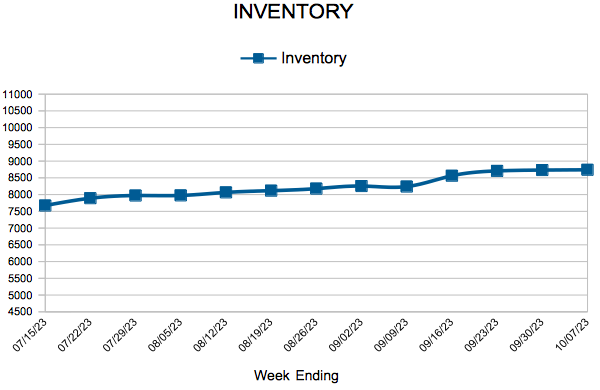

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 7:

- New Listings decreased 4.4% to 1,226

- Pending Sales increased 2.3% to 836

- Inventory decreased 7.7% to 8,740

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.3% to $370,805

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending September 30, 2023

For Week Ending September 30, 2023

Nationally, pending home sales decreased 7.1% month-over-month as of last measure, falling to the lowest level since April 2020, according to the National Association of REALTORS®, as rising borrowing costs and a scarcity of new listings continue to impact market activity. Pending sales declined in all four regions and were down 18.7% year-over-year, with the smallest monthly declines noted in the Northeast (-0.9%) and the Midwest (-7.0%).

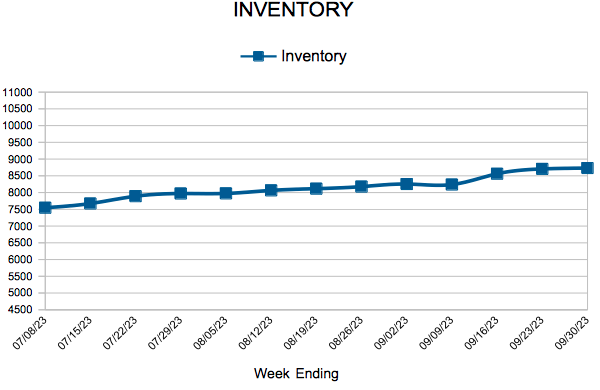

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 30:

- New Listings decreased 9.8% to 1,174

- Pending Sales decreased 2.0% to 895

- Inventory decreased 7.4% to 8,732

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.7% to $380,000

- Days on Market increased 18.5% to 32

- Percent of Original List Price Received increased 0.1% to 100.0%

- Months Supply of Homes For Sale increased 21.1% to 2.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending September 23, 2023

For Week Ending September 23, 2023

New-home construction recently fell to a 3-year low, as higher mortgage rates take their toll on homebuilders, impacting affordability and causing production to slow. According to the U.S. Census Bureau, housing starts dropped 11.3% from the previous month, led by a decline in multi-family construction. Although starts fell more than economists predicted, building permits increased over the same period, rising 6.9% from the previous month.

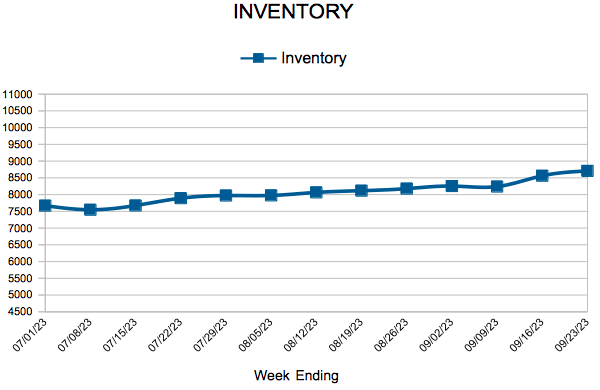

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 23:

- New Listings decreased 3.8% to 1,252

- Pending Sales decreased 10.0% to 894

- Inventory decreased 8.7% to 8,707

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.7% to $380,000

- Days on Market increased 18.5% to 32

- Percent of Original List Price Received increased 0.1% to 100.0%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending September 16, 2023

For Week Ending September 16, 2023

Single-family homes are shrinking, as U.S. homebuilders respond to increased demand for smaller, more affordable homes. According to the U.S. Census Bureau, median single-family square floor area declined 2.9% to 2,191 square feet in the second quarter of 2023, the lowest reading since 2010. Single-family home size increased briefly during the COVID-19 pandemic, but has been decreasing steadily since the third quarter of 2022, as housing affordability conditions continue to impact buyer purchasing power.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 16:

- New Listings decreased 3.2% to 1,413

- Pending Sales decreased 2.9% to 905

- Inventory decreased 9.3% to 8,562

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.7% to $380,000

- Days on Market increased 18.5% to 32

- Percent of Original List Price Received increased 0.1% to 100.0%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 19

- 20

- 21

- 22

- 23

- …

- 40

- Next Page »