Weekly Market Report

For Week Ending September 9, 2023

For Week Ending September 9, 2023

Mortgage applications fell to their lowest level since 1996, with total mortgage applications dropping 0.8% from the previous week, according to the Mortgage Bankers Association (MBA), as higher mortgage interest rates continue to take their toll on market participants. Applications to purchase a home were 27% lower than the same week a year ago, while demand for refinances was down 31% compared to the same week last year.

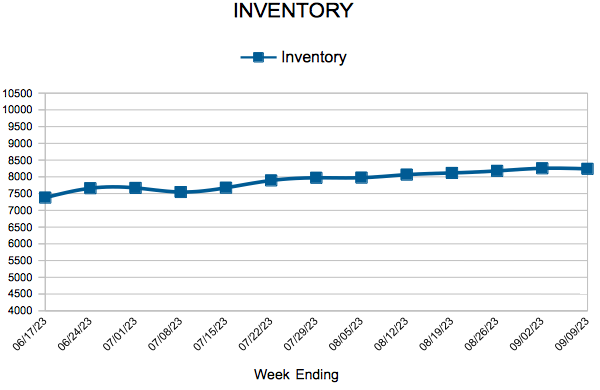

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 9:

- New Listings decreased 2.4% to 1,400

- Pending Sales decreased 16.7% to 692

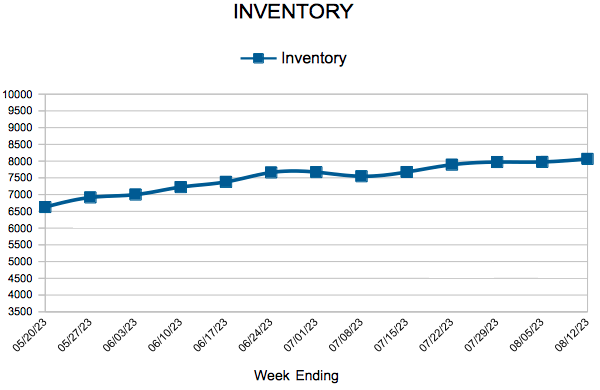

- Inventory decreased 10.3% to 8,239

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 2.7% to $380,000

- Days on Market increased 18.5% to 32

- Percent of Original List Price Received increased 0.1% to 100.0%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending September 2, 2023

For Week Ending September 2, 2023

The lack of existing-home inventory continues to boost demand for new construction homes, and U.S. homebuilders are ramping up production to help meet buyers’ needs. According to the U.S. Census Bureau, total housing starts rose 3.9% month-over-month to a seasonally adjusted rate of 1.452 million, and were up 5.9% from the same period last year, exceeding economists’ expectations. Much of the increase was due to single-family starts, which grew 6.7% month-over-month, led by gains in the Midwest and West regions.

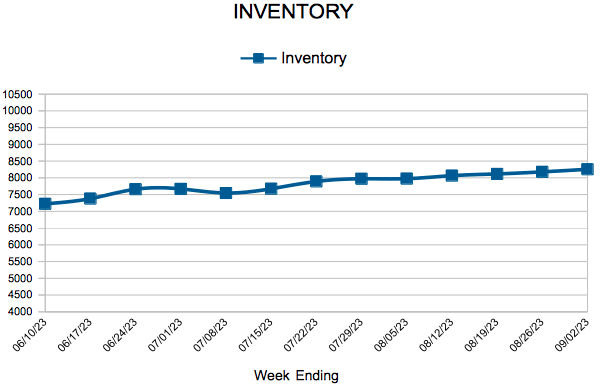

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 2:

- New Listings decreased 2.1% to 1,185

- Pending Sales decreased 6.1% to 933

- Inventory decreased 11.3% to 8,255

FOR THE MONTH OF JULY:

- Median Sales Price remained flat at $375,000

- Days on Market increased 31.8% to 29

- Percent of Original List Price Received decreased 0.7% to 100.8%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 26, 2023

For Week Ending August 26, 2023

U.S. home equity recently hit a 4-year high, with nearly half of all mortgage borrowers considered equity rich—having a loan to value ratio of 50% or lower—in the second quarter of this year. According to ATTOM’s Q2 2023 U.S. Home Equity and Underwater Report, 49% of mortgaged residential homes were equity rich, up from 47% in the first quarter of the year, with quarterly increases found in 45 states. The highest levels of equity-rich mortgaged properties continue to be found in the West, with six of the top 10 states in the second quarter located in that region.

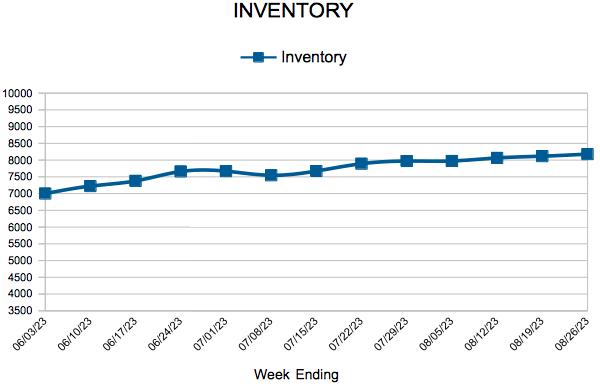

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 26:

- New Listings increased at 1,282

- Pending Sales decreased 9.2% to 923

- Inventory decreased 12.7% to 8,178

FOR THE MONTH OF JULY:

- Median Sales Price remained flat at $375,000

- Days on Market increased 31.8% to 29

- Percent of Original List Price Received decreased 0.7% to 100.8%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 19, 2023

For Week Ending August 19, 2023

International buyers of U.S. homes purchased 14.2% fewer homes from April 2022 to March 2023 compared to the same 12-month period a year before, according to the latest data from the National Association of REALTORS® (NAR). Foreign buyers purchased 84,600 homes, marking the fewest number of properties purchased annually by foreign buyers since 2009, when NAR began tracking this data. Although sales were down, home prices have continued to rise, with the median existing-home sales price among international buyers hitting $396,400, the highest ever recorded by NAR.

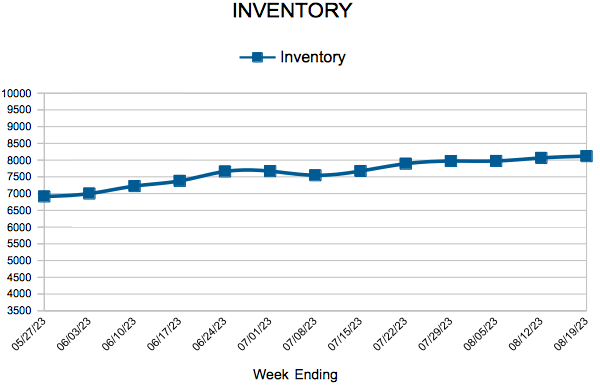

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 19:

- New Listings decreased 3.1% to 1,324

- Pending Sales decreased 15.0% to 966

- Inventory decreased 14.0% to 8,117

FOR THE MONTH OF JULY:

- Median Sales Price increased at $375,250

- Days on Market increased 31.8% to 29

- Percent of Original List Price Received decreased 0.7% to 100.8%

- Months Supply of Homes For Sale increased 10.5% to 2.1

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending August 12, 2023

For Week Ending August 12, 2023

Seller profit margins are up nationwide following three quarterly declines, according to ATTOM’s Q2 2023 U.S. Home Sales Report. Typical profit margins on medianpriced single-family and condo sales climbed to 47.7% in the second quarter of 2023, up from 43.9% the previous quarter, representing the first increase in a year. The rise in profit margins was boosted by recent growth in median single-family home and condo prices, which increased in more than 90% of the country in Q2, according to the report.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 12:

- New Listings decreased 7.4% to 1,398

- Pending Sales decreased 10.5% to 1,068

- Inventory decreased 14.4% to 8,065

FOR THE MONTH OF JULY:

- Median Sales Price remained flat at $375,000

- Days on Market increased 31.8% to 29

- Percent of Original List Price Received decreased 0.7% to 100.8%

- Months Supply of Homes For Sale increased 10.5% to 2.1

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 20

- 21

- 22

- 23

- 24

- …

- 40

- Next Page »