Weekly Market Report

For Week Ending May 27, 2023

For Week Ending May 27, 2023

Sales prices of existing homes rose in nearly 70% of metropolitan areas in the first quarter of 2023, according to the latest quarterly report from the National Association of REALTORS® (NAR). Despite the increase, however, affordability improved slightly from the fourth quarter of 2022, when 90% of metropolitan areas saw annual sales price increases. On average, families spent 24.5% of their monthly income on mortgage payments in the first quarter this year, compared to 26.2% in the fourth quarter last year.

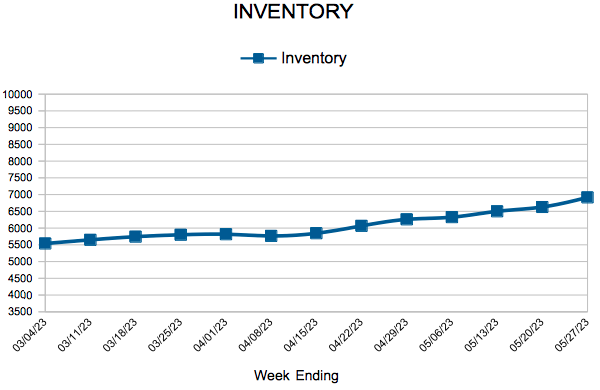

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 27:

- New Listings decreased 19.3% to 1,355

- Pending Sales decreased 19.1% to 1,184

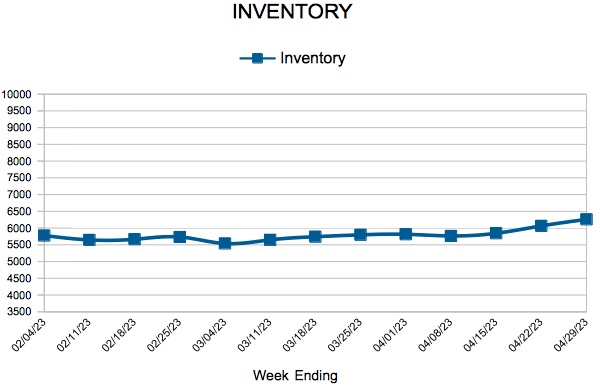

- Inventory decreased 5.7% to 6,915

FOR THE MONTH OF APRIL:

- Median Sales Price remained flat at $369,900

- Days on Market increased 64.3% to 46

- Percent of Original List Price Received decreased 3.6% to 100.1%

- Months Supply of Homes For Sale increased 33.3% to 1.6

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending May 20, 2023

For Week Ending May 20, 2023

The number of homes available for sale was up 48.3% year-over-year in April, according to Realtor.com’s latest Monthly Housing Market Trends Report, although inventory remains well below pre-pandemic levels. Inventory increased in 42 out of 50 of the largest metros annually, with the typical home spending 41 days on market, up from 26 days the same time last year. Nationally, listing price growth has also softened, rising 2.85% year-over-year, the lowest rate of growth since April 2020.

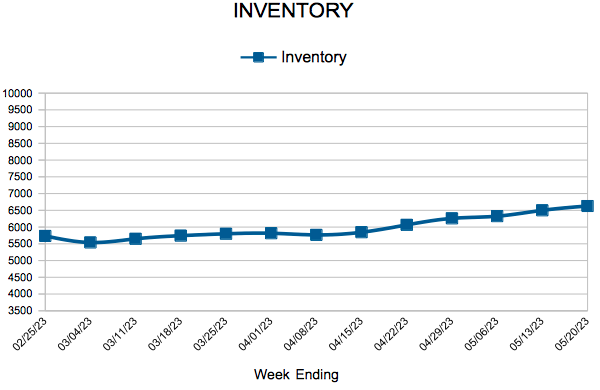

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 20:

- New Listings decreased 21.9% to 1,630

- Pending Sales decreased 28.6% to 1,063

- Inventory decreased 7.3% to 6,629

FOR THE MONTH OF APRIL:

- Median Sales Price decreased 0.3 percent to $369,000

- Days on Market increased 64.3% to 46

- Percent of Original List Price Received decreased 3.6% to 100.1%

- Months Supply of Homes For Sale increased 33.3% to 1.6

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending May 13, 2023

For Week Ending May 13, 2023

May is the best month to sell a home, according to a recent analysis by ATTOM Data Solutions, which found that, on average, sellers saw a premium of 12.8% above market value when selling in May. June and April are the second and third best months to sell, with sellers receiving average premiums of 10.7% and 10.3%, respectively. The analysis studied over 51 million home sales between 2011 and 2022 and found that the largest premiums were achieved by sellers who sold in late spring and early summer.

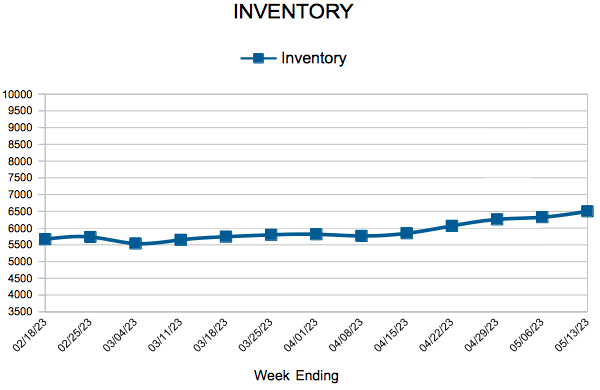

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 13:

- New Listings decreased 26.1% to 1,422

- Pending Sales decreased 13.0% to 1,128

- Inventory decreased 2.3% to 6,500

FOR THE MONTH OF APRIL:

- Median Sales Price decreased at $368,580

- Days on Market increased 64.3% to 46

- Percent of Original List Price Received decreased 3.6% to 100.1%

- Months Supply of Homes For Sale increased 33.3% to 1.6

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending May 6, 2023

For Week Ending May 6, 2023

Mortgage interest rates fell slightly following the Federal Reserve’s recent decision to raise its benchmark short-term interest rate by a quarter percentage point this month, its 10th interest rate hike since March 2022. According to Freddie Mac, the 30-year fixed-rate mortgage averaged 6.39% the week ending 5/4/23, up from 5.27% a year ago. Many economists expect mortgage interest rates will continue to soften over the year due to cooling inflation.

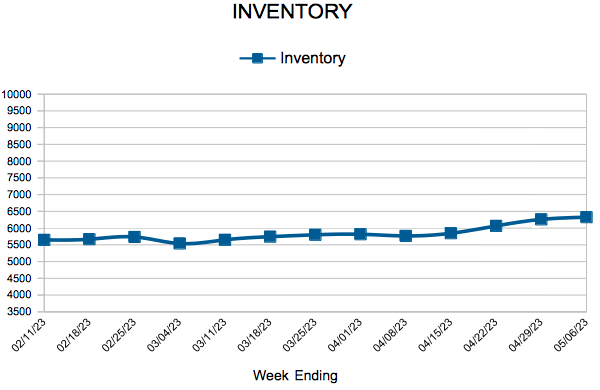

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 6:

- New Listings decreased 18.2% to 1,533

- Pending Sales decreased 23.4% to 1,096

- Inventory increased at 6,325

FOR THE MONTH OF MARCH:

- Median Sales Price remained flat at $355,000

- Days on Market increased 65.7% to 58

- Percent of Original List Price Received decreased 4.0% to 98.6%

- Months Supply of Homes For Sale increased 36.4% to 1.5

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending April 29, 2023

For Week Ending April 29, 2023

Homeownership remains a key driver to building wealth. According to a recent report from the National Association of REALTORS®, middle-class homeowners saw the median value of their homes appreciate $122,070, or 68%, over the last decade. Meanwhile, lower income homeowners saw a 75% gain in the median value of their homes, with an increase of $98,910 in wealth solely from home price appreciation, while upper income homeowners saw an increase of $150,810 in wealth from their homes in the last 10 years.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 29:

- New Listings decreased 27.3% to 1,303

- Pending Sales decreased 26.2% to 1,045

- Inventory increased 2.7% to 6,259

FOR THE MONTH OF MARCH:

- Median Sales Price remained flat at $355,000

- Days on Market increased 65.7% to 58

- Percent of Original List Price Received decreased 4.0% to 98.6%

- Months Supply of Homes For Sale increased 36.4% to 1.5

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 24

- 25

- 26

- 27

- 28

- …

- 41

- Next Page »