Weekly Market Report

For Week Ending January 7, 2023

For Week Ending January 7, 2023

Fannie Mae recently announced changes to its automated underwriting system intended to simplify the loan process and help create more homeownership opportunities for underserved borrowers lacking an established credit history. The changes include updating eligibility criteria for loans where borrowers do not have a credit score, using borrowers’ bank statements to determine cash flow and balance trends, and providing an automated option for lenders to document nontraditional credit sources.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 7:

- New Listings decreased 5.3% to 808

- Pending Sales decreased 30.5% to 386

- Inventory increased 18.4% to 5,999

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 4.4% to $354,900

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 50.0% to 1.8

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

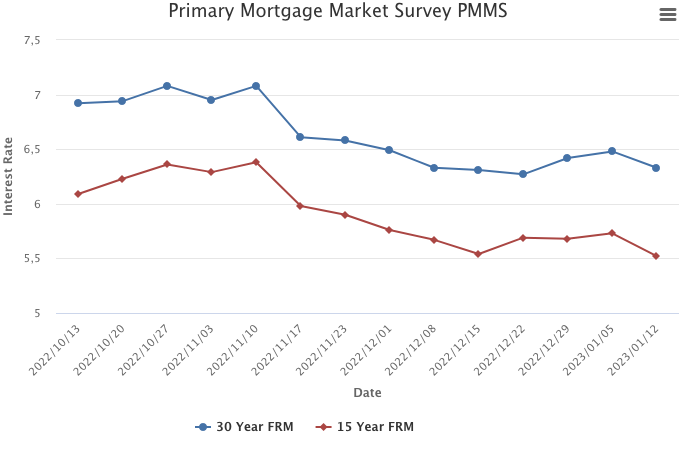

Mortgage Rates Decline

January 12, 2023

While mortgage rates have resumed their decline, the market remains hypersensitive to rate movements, with purchase demand experiencing large swings relative to small changes in rates. Over the last few weeks latent demand has been on display with buyers jumping in and out of the market as rates move.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending December 31, 2022

For Week Ending December 31, 2022

Rental prices are rising at the slowest pace in 19 months, with rents up 3.4% nationally as of last measure, marking the 10th consecutive month of slowing rent growth, according to Realtor.com’s recent Rental Report. Among the 50 largest metropolitan markets, the median asking rent declined $22 month-to-month to $1,712 and was down $69 from July 2022’s peak of $1,781. Rents in Sun Belt markets slowed at a faster rate than rents in the Midwest and in big metros such as Boston, Chicago, and New York, which have seen stronger rental growth this year.

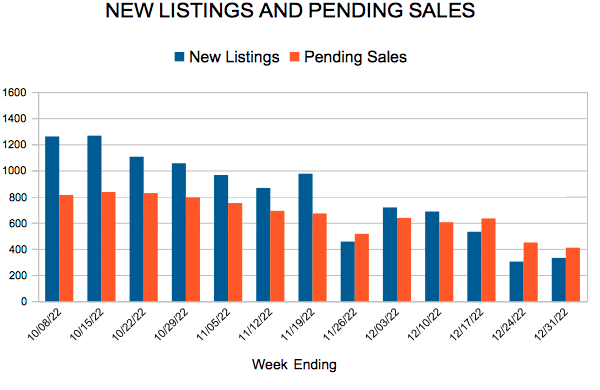

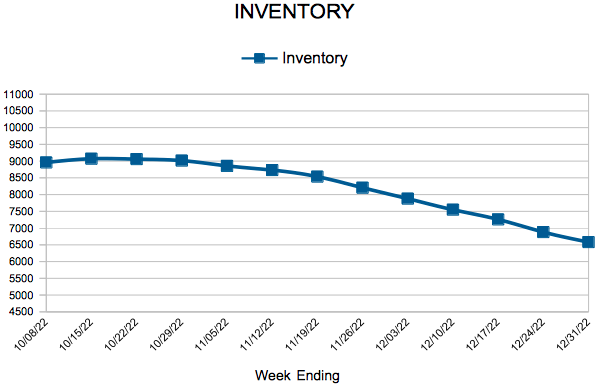

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 31:

- New Listings decreased 22.7% to 331

- Pending Sales decreased 29.0% to 409

- Inventory increased 20.2% to 6,582

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 4.4% to $354,900

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 50.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

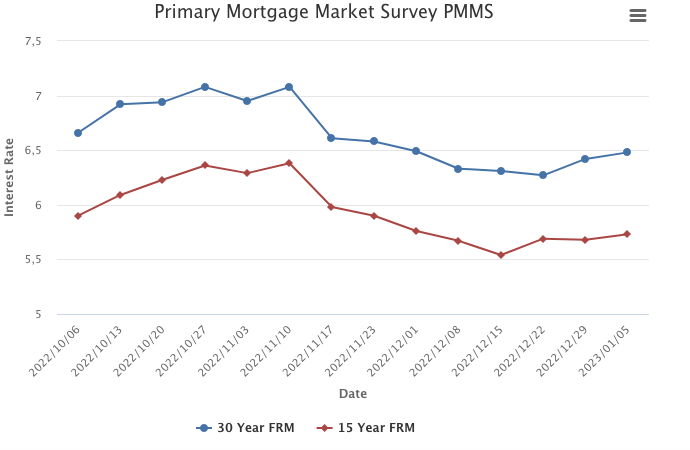

Mortgage Rates Inch Up

January 5, 2023

Mortgage application activity sunk to a quarter century low this week as high mortgage rates continue to weaken the housing market. While mortgage market activity has significantly shrunk over the last year, inflationary pressures are easing and should lead to lower mortgage rates in 2023. Homebuyers are waiting for rates to decrease more significantly, and when they do, a strong job market and a large demographic tailwind of Millennial renters will provide support to the purchase market. Moreover, if rates continue to decline, borrowers who purchased in the last year will have opportunities to refinance into lower rates.

Information provided by Freddie Mac.

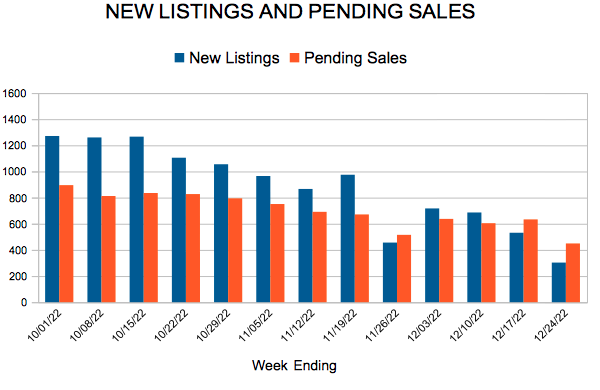

New Listings and Pending Sales

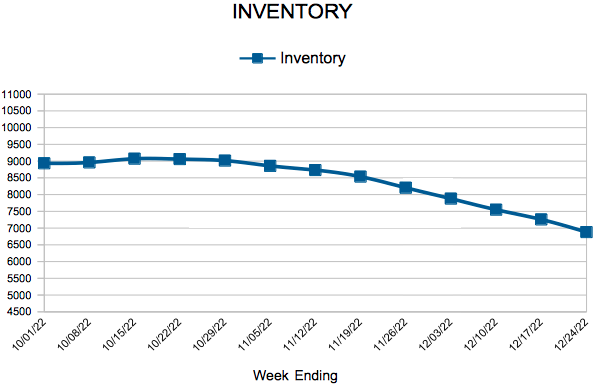

Inventory

Weekly Market Report

For Week Ending December 24, 2022

For Week Ending December 24, 2022

Elevated mortgage rates continue to take a toll on the construction industry, with housing permits for new homes falling 11.2% in November, according to the Commerce Department. Housing starts were down 0.5% over the same time period, with the annual rate of housing starts down 16.4% from the previous year. Overall construction was strongest in the West and the South, while single-family construction was strongest in the West and Northeast.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 24:

- New Listings decreased 5.6% to 303

- Pending Sales decreased 20.8% to 449

- Inventory increased 18.8% to 6,881

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 4.1% to $354,000

- Days on Market increased 33.3% to 40

- Percent of Original List Price Received decreased 2.6% to 97.2%

- Months Supply of Homes For Sale increased 50.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 62

- 63

- 64

- 65

- 66

- …

- 89

- Next Page »